OptionsHunter assumes that options traded at the bid are sold and at the offer are buys, hence the former is bearish and the latter bullish. One should still look at how the stock price reacts to the trade. Every large sweep/ block trade is shown in OptionsHunter and there is a buyer and a seller. Suggest looking for volume > OI as another clue as well as the strike relative to the price. Volume > OI at the offer is a likely buy.

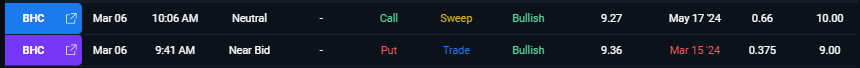

Trade - Trade was executed through a single brokerage

Sweep - Trade was executed across multiple brokerages.

A Sweep is typically a large order that is broken into a number of different smaller orders that can then be filled more quickly on multiple exchanges.

TOP BULLISH FLOW: Aggregate total of Bullish activity for a symbol

TOP BEARISH FLOW: Aggregate total of Bearish activity for a symbol

WITHIN EARNINGS: Within two weeks of earnings

EXPIRING SOON: 14 days or fewer until the contract expires

AGGRESSIVE: At or above the offer, and volume is greater than Open Interest

AGGRESSIVE WITH SIZE: At or above the offer, and size is much greater than average

AGGRESSIVE WITH OFFERS: At or above the offer

BULLISH HOT MONEY: Out-of-the-money bullish sweeps that have unusual volume, and are typically nearer to the ask than the bid

BEARISH HOT MONEY: Out-of-the-money bearish sweeps that have unusual volume, and are typically nearer to the ask then the bid

HEAT INDEX - The daily volume is multiple times above the average volume

$1 million+ Orders: Green rows tell you when an order is over $1,000,000

Highly Unusual Orders: Purple rows indicate an order has less than 14 days to expiration, a Size greater than or equal to 5,000, and the Size is greater than or equal to Open Interest

Unusual Orders: Blue rows tell you when Order Size is greater than or equal to Open Interest.